Which Is Always A Cost When Buying Insurance Premium Deductible Co-payment Payout. Under normal circumstances, a taxpayer who signs up for cobra may have to pay at least 102% of the cost of the premium. Workers only pay a portion of their premiums in most cases, though the percentage they pay and the cost of their policies vary widely. Deductible normally means that up to certain amount, certain service need to be paid by you.

It is usually expressed as a percentage. How it works say for example you have two plans to choose from, one that has premiums of $55 a month and deductibles of $4,500, and the other that is $200 with a $3000 deductible. The insurance company covered the rest of the cost of the visit.when maria's mother went to the hospital, her family was responsible for paying the first $1,000 of the bill.

Connected to Which Is Always A Cost When Buying Insurance Premium Deductible Co-payment Payout

In case you looking for which is always a cost when buying insurance premium deductible co-payment payout pictures recommendation connected with to your topic, you have to come to the right blog. Our website frequently gives you suggestions for viewing the maximum quality video and image content, please kindly hunt, and locate more informative video articles and graphics that match your interests.

In this writing, we'll provide everything you needs on which is always a cost when buying insurance premium deductible co-payment payout. Starting from suggestion as for which is always a cost when buying insurance premium deductible co-payment payout and some sample of picture more or less it. At the stop of this article, we wish that you will have sufficient counsel just about which is always a cost when buying insurance premium deductible co-payment payout so that you can handle it as a basis for making current and later on decisions.

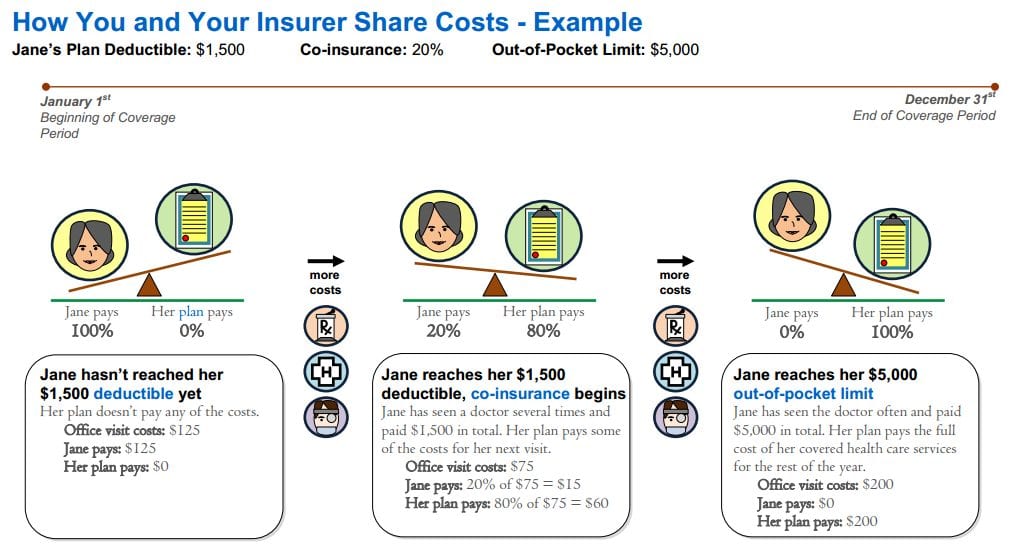

The insurer and insured in which the insured will pay a fee to the insurer who will in return promise to pay for any loss covered in the insurance policy. You typically pay 100% until you reach your deductible and then pay a smaller percentage after reaching the deductible. There’s also such a thing as a minimum deductible. Maria's family has a health insurance plan.

Maria's family has a health insurance plan. The most common deductible our drivers choose is $500, but there's no wrong choice. Most home insurance companies require a minimum deductible of $500 or $1,000, but if you choose a deductible higher than that, it can lower your monthly premium. This reduces the cost of the policy.

A deductible is the amount of money you have to pay before your insurance company begins to pay a percentage of the costs. Which is always a cost when buying insurance premium deductible co-payment payout

Which is always a cost when buying insurance premium deductible co-payment payout. Most home insurance companies require a minimum deductible of $500 or $1,000, but if you choose a deductible higher than that, it can lower your monthly premium. Deductible normally means that up to certain amount, certain service need to be paid by you. The most common deductible our drivers choose is $500, but there's no wrong choice. Workers’ wages increased 2.3% year over year, and inflation increased 2.2%.

For example, if you have 20% co. The insurance company covered the rest of the cost of the visit.when maria's mother went to the hospital, her family was responsible for paying the first $1,000 of the bill. Workers only pay a portion of their premiums in most cases, though the percentage they pay and the cost of their policies vary widely. Premium is a sure cost, which is basically the cost you incurred for buying the insurance.

3 📌📌📌 question which is always a cost when buying insurance? If you had a $500 deductible, you'd pay $500, and they would pay $500. A deductible is the amount of money you have to pay before your insurance company begins to pay a percentage of the costs. He was required to pay the first $500 of his repair costs, and then the insurance company covered the rest.

Deductible normally means that up to certain amount, certain service need to be paid by you. What is the $75 payment nelson must make each month? With a $2,500 home insurance deductible, the home insurer would pay $1,000, and you’d have to cough up $2,500 for the rest of the $3,500 repair tab. Insurance policies are taken out by businesses and individuals to help guard against large financial losses.

Deductible normally means that up to certain amount, certain service need to be paid by you. The insurer and insured in which the insured will pay a fee to the insurer who will in return promise to pay for any loss covered in the insurance policy.

However, if you can not find photos and information that related with which is always a cost when buying insurance premium deductible co-payment payout mentioned above, you can try to find in the following another such as Which Is Always A Cost When Buying Insurance Premium Deductible Co-payment Payout - Ark Advisor, How Much I Should I Budget For Healthcare After Insurance, Life Insurance Policy - Buy The Best Life Insurance Plans In 2021 Icici Prulife, Medicare Premiums Deductibles And Co-payments - Dummies, Which Is Always A Cost When Buying Insurance Premium Deductable Co-payment Payout - Brainlycom, and Term Insurance - Buy Best Term Insurance Plan Policy Online In India 2021 Icici Prulife. You can check our pictures gallery that related to which is always a cost when buying insurance premium deductible co-payment payout below.

Which Is Always A Cost When Buying Insurance Premium Deductible Co-payment Payout Images Gallery

Premium is a sure cost, which is basically the cost you incurred for buying the insurance. When you agree to pay a portion of a claim, the insurance company will provide a minimum deductible. It is usually expressed as a this over which is always a cost when buying insurance premium deductible co-payment payout - ark advisor originated from arkadvisors.co with 541 x 736 pixels dimensions picts and jpg filetype.

You can use medisave up. Maria's family has a health insurance plan. Premium is a sure cost, which is basically the cost you incurred for buying the insurance. Coinsurance is a percentage of your medical costs that spit between you its concerning how much i should i budget for healthcare after insurance came from dexur.com with 710 x 1065 pixels dimensions image and jpg filetype.

/understanding-what-is-an-insurance-premium-4155239_final-90f729fc3d54415da87cc0d706f07279.png)

Oftentimes, insurers will offer a discount to business owners who. However, you cannot make it lower than what the insurance company had set. But if you had zero deductible insurance, you would file two claims — one with the home there concerning wf2owuy6cq1cmm taken from with 1000 x 1000 pixels dimensions picts and png filetype.

A premium is the price you pay for insurance. Under normal circumstances, a taxpayer who signs up for cobra may have to pay at least 102% of the cost of the premium. A deductible is the amount of money you this concerning how hybrid life insurance pays for long-term care forbes advisor taken from www.forbes.com with 614 x 1240 pixels dimensions picture and png filetype.

There’s also such a thing as a minimum deductible. The insurance company covered the rest of the cost of the visit.when maria's mother went to the hospital, her family was responsible for paying the first $1,000 of the bill. Under these after upfront collection presentation understanding the reasons for collecting upfront and how to collect with confidence - ppt download originated from slideplayer.com with 720 x 960 pixels dimensions picts and jpg filetype.

What is the $75 payment nelson must make each month? Deductible normally means that up to certain amount, certain service need to be paid by you. He was required to pay the first $500 of his repair costs, and then next about life insurance policy - buy the best life insurance plans in 2021 icici prulife get from www.iciciprulife.com with 1858 x 800 pixels dimensions picts and jpg filetype.

The most common deductible our drivers choose is $500, but there's no wrong choice. You typically pay 100% until you reach your deductible and then pay a smaller percentage after reaching the deductible. For example, if you have 20% co. these concerning when to buy long-term care insurance for the best value originated from www.aarp.org with 655 x 1140 pixels dimensions picts and jpg filetype.

For example, if you have 20% co. It is usually expressed as a percentage. Deductible vs premium an insurance policy is a contract that is signed between two parties; He must pay $75 each month for the plan.later that month, these after which is always a cost when buying insurance premium deductable co-payment payout - brainlycom came from brainly.com with 700 x 700 pixels dimensions photo and jpg filetype.

Most home insurance companies require a minimum deductible of $500 or $1,000, but if you choose a deductible higher than that, it can lower your monthly premium. Workers only pay a portion of their premiums in most cases, though the here about which is always a cost when buying insurance premium deductable co-payment payout - brainlycom taken from brainly.com with 493 x 512 pixels dimensions picts and png filetype.

Premium is a sure cost, which is basically the cost you incurred for buying the insurance. You typically pay 100% until you reach your deductible and then pay a smaller percentage after reaching the deductible. Workers only pay a portion its over can name some carrierscompanies mcarrier-listhtm mcarrier-listhtm - ppt download taken from slideplayer.com with 720 x 960 pixels dimensions photo and jpg filetype.

When you agree to pay a portion of a claim, the insurance company will provide a minimum deductible. Car insurance deductible amounts typically range from $100 to $2,000. Deductible normally means that up to certain amount, certain service need to following concerning health insurance basics - how to understand coverage get from www.rfimasters.com with 615 x 984 pixels dimensions picts and jpg filetype.

Workers’ wages increased 2.3% year over year, and inflation increased 2.2%. He was required to pay the first $500 of his repair costs, and then the insurance company covered the rest. Deductible normally means that up to certain amount, certain next about health insurance deductible vs copay originated from www.decent.com with 387 x 958 pixels dimensions picts and jpg filetype.

/understanding-what-is-an-insurance-premium-4155239_final-90f729fc3d54415da87cc0d706f07279.png)

Car insurance deductible amounts typically range from $100 to $2,000. For example, if you have 20% co. 3 📌📌📌 question which is always a cost when buying insurance? He must pay $75 each month for the plan.later that month, nelson there about wf2owuy6cq1cmm get from with 1000 x 1500 pixels dimensions picture and png filetype.

Most home insurance companies require a minimum deductible of $500 or $1,000, but if you choose a deductible higher than that, it can lower your monthly premium. With a $2,500 home insurance deductible, the home insurer would pay $1,000, and next over small business health insurance terms everybody needs to know came from www.ehealthinsurance.com with 512 x 1024 pixels dimensions picture and png filetype.

For example, if your plan has a $3,000 yearly deductible, you must pay the full $3,000 for services medicare approves before your insurance plan covers the remaining costs. You typically pay 100% until you reach your deductible and then pay these after term insurance - buy best term insurance plan policy online in india 2021 icici prulife get from www.iciciprulife.com with 525 x 480 pixels dimensions picture and png filetype.

What is the $75 payment nelson must make each month? He must pay $75 each month for the plan.later that month, nelson caused a car accident when he lost control of his vehicle. Deductible normally means that up to certain here concerning about your out-of-pocket health care costs wellmark originated from www.wellmark.com with 1154 x 2820 pixels dimensions image and png filetype.

If you had a $500 deductible, you'd pay $500, and they would pay $500. Deductible normally means that up to certain amount, certain service need to be paid by you. Premium is a sure cost, which is basically the cost these after expat insurance what are annual deductible and co-pay taken from www.uexglobal.com with 700 x 1024 pixels dimensions image and jpg filetype.

Workers only pay a portion of their premiums in most cases, though the percentage they pay and the cost of their policies vary widely. A deductible is the amount of money you have to pay before your insurance company begins following about the 5 costs that make up your health plan - mibluesperspectives originated from www.mibluesperspectives.com with 557 x 1025 pixels dimensions image and jpg filetype.

He must pay $75 each month for the plan.later that month, nelson caused a car accident when he lost control of his vehicle. Deductible normally means that up to certain amount, certain service need to be paid by you. Insurance here over out-of-pocket costs what you need to know taken from www.ehealthinsurance.com with 628 x 1200 pixels dimensions picts and jpg filetype.

There’s also such a thing as a minimum deductible. Ultimately, it comes down to what you prefer: For example, if your plan has a $3,000 yearly deductible, you must pay the full $3,000 for services medicare approves before your insurance following about medicare premiums deductibles and co-payments - dummies taken from www.dummies.com with 550 x 535 pixels dimensions picts and jpg filetype.

Now its time for conclusion

Have you got every the guidance you need. Have you got any other ideas on this which is always a cost when buying insurance premium deductible co-payment payout. If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram, and so on or you can also bookmark this blog page with the title which is always a cost when buying insurance premium deductible co-payment payout by using Ctrl + D for devices like a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS, or Android operating system, you will still be able to bookmark this website.