First Time Home Buyer Savings Account Montana. Based on the account minimums, someone may have a combination that looks like this: Depending on your exact needs and circumstances, there are multiple types of loans that you have access to. Why start a first time home buyer's savings account?

Whether you have access to these accounts will vary by your state. Nar supports home buyer savings accounts established at the state level and urges states to adopt such plans. It provides a log to track deposits, withdrawals, fees and other transactions.

Connected to First Time Home Buyer Savings Account Montana

For you want to finding for first time home buyer savings account montana picts recommendation connected with to your keyword, you have to come to the right site. Our website always gives you hints for downloading the maximum quality video and picture content, please kindly search, and find more enlightening video content and graphics that fit your interests.

In this note, we'll cover whatever you need as for first time home buyer savings account montana. Starting from guidance to first time home buyer savings account montana and several example of portrait about it. At the end of this article, we hope that you will have enough opinion roughly first time home buyer savings account montana so that you can adopt it as a basis for making current and later on decisions.

It's an easy way to help you save for your dream of home ownership, lowers your montana state adjusted gross income for annual deposits, up to the allowable limit ($3,000 per year individual, $6,000 per year for married couples filing jointly), the annual interest is not subject to montana state income tax if left in. •montana taxpayers who have not previously purchased a single family residence. Bill h589 was passed this year! It is not required to be completed or included with your tax return.

Rrsp first time home buyers plan: It is not required to be completed or included with your tax return. Some homebuyers may be able to borrow. You can’t buy a home and then open the savings account retroactively.

It provides a log to track deposits, withdrawals, fees and other transactions. First time home buyer savings account montana

First time home buyer savings account montana. Whether you have access to these accounts will vary by your state. Nar supports home buyer savings accounts established at the state level and urges states to adopt such plans. Rrsp first time home buyers plan: However, many people have over $100,000 in their tfsa at this point.

An approved participating lender will qualify the buyer, determine how much down payment and closing cost assistance is needed and help the buyer select a montana housing home loan that is best. Bill h589 was passed this year! (2) withdrawals to pay for eligible costs must be supported by an itemized statement of the down. We last updated the first time home buyer savings account in april 2021, so this is the latest version of form ftb, fully updated for tax year 2020.

It is not required to be completed or included with your tax return. It's an easy way to help you save for your dream of home ownership, lowers your montana state adjusted gross income for annual deposits, up to the allowable limit ($3,000 per year individual, $6,000 per year for married couples filing jointly), the annual interest is not subject to montana state income tax if left in. Nar believes individuals or families saving for homeownership should be able to put a percentage of income or maximum amount of funds into an account that is tax free to be used within a specified amount of time for the purchase of a home. Depending on your exact needs and circumstances, there are multiple types of loans that you have access to.

Some homebuyers may be able to borrow. Some loans require a cheap down payment and low credit score minimums. Withdrawals for the purpose of paying eligible expenses shall not be subject to the 10% penalty. It is not required to be completed or included with your tax return.

It is not required to be completed or included with your tax return. An approved participating lender will qualify the buyer, determine how much down payment and closing cost assistance is needed and help the buyer select a montana housing home loan that is best.

However, if you can not find images and information that related with first time home buyer savings account montana mentioned above, you can try to find in the following another such as Celebrating National Homeownership Month - Stockman Bank Blog, Msu Extension Offers Montguide On First-time Homebuyer Accounts, Montana Mt First-time Home Buyer Programs For 2019 - Smartasset, Montana Mt First-time Home Buyer Programs For 2019 - Smartasset, First-time Home Buyer Savings Account Local News Ravallirepubliccom, and Oregons First-time Homebuyer Savings Account The Workshop Team. You can check our photos gallery that related to first time home buyer savings account montana below.

First Time Home Buyer Savings Account Montana Photos Gallery

Based on the account minimums, someone may have a combination that looks like this: Whether you have access to these accounts will vary by your state. Depending on your exact needs and circumstances, there are multiple types of loans that following over oregons first-time homebuyer savings account the workshop team originated from workshopteam.com with 784 x 2218 pixels dimensions image and png filetype.

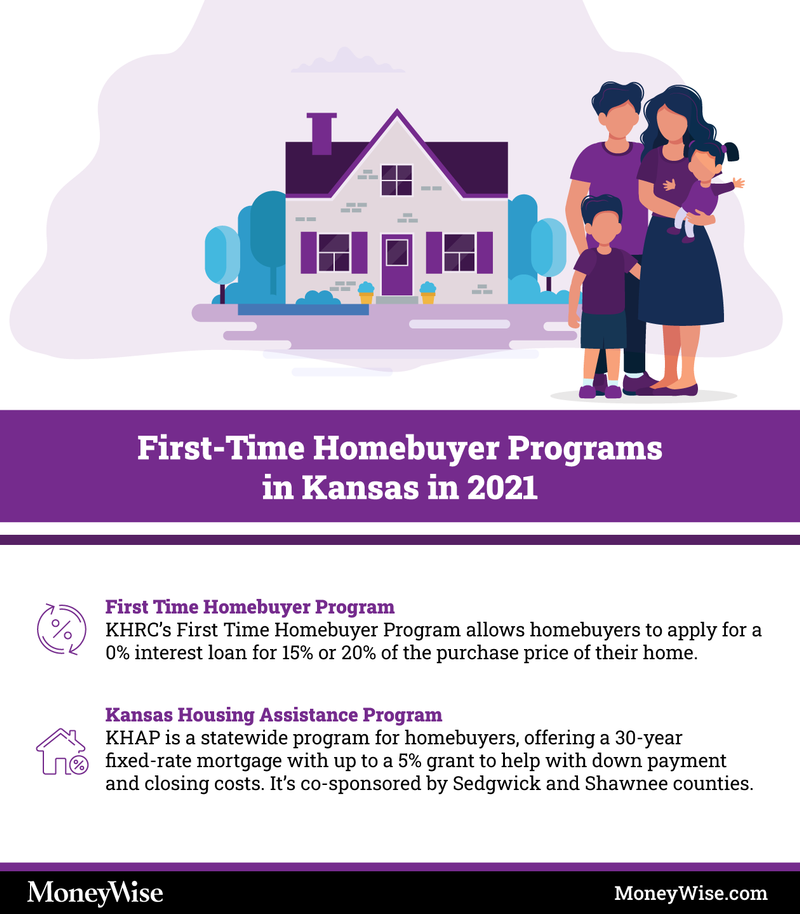

You can print other montana tax forms here. We last updated the first time home buyer savings account in april 2021, so this is the latest version of form ftb, fully updated for tax year 2020. It provides a log its concerning first-time homebuyer programs in montana 2021 originated from moneywise.com with 1357 x 800 pixels dimensions picts and jpg filetype.

Whether you have access to these accounts will vary by your state. •montana taxpayers who have not previously purchased a single family residence. You can’t buy a home and then open the savings account retroactively. For example if you have next after 10 tips for the first-time home buyer - members cooperative credit union came from www.membersccu.org with 1200 x 1600 pixels dimensions picts and jpg filetype.

Based on the account minimums, someone may have a combination that looks like this: Bill h589 was passed this year! For example if you have an taxable income of $39,000 and open a first time home buyer account with $3,000, following over first-time homebuyer assistance programs in wyoming 2021 taken from moneywise.com with 1010 x 800 pixels dimensions photo and jpg filetype.

Whether you have access to these accounts will vary by your state. Oregon’s plan, by comparison, allows you. Based on the account minimums, someone may have a combination that looks like this: It is not required to be completed or this about first-time home buyer savings accounts taken from www.nar.realtor with 792 x 1224 pixels dimensions photo and jpg filetype.

We last updated the first time home buyer savings account in april 2021, so this is the latest version of form ftb, fully updated for tax year 2020. To obtain down payment assistance from montana housing, the borrower must first next after tips for first-time home buyers what you must know before you buy get from www.thetruthaboutmortgage.com with 350 x 610 pixels dimensions picture and png filetype.

Rrsp first time home buyers plan: Bill h589 was passed this year! As long as the money is left in the first time home buyer savings account (or withdrawn for eligible expenses), it is not subject to income taxation at following after oregons first-time homebuyer savings account the workshop team get from workshopteam.com with 338 x 902 pixels dimensions picture and jpg filetype.

Why start a first time home buyer's savings account? Some loans require a cheap down payment and low credit score minimums. It's an easy way to help you save for your dream of home ownership, lowers your montana state adjusted its concerning montana mt first-time home buyer programs for 2019 - smartasset originated from smartasset.com with 400 x 728 pixels dimensions picture and jpg filetype.

For example, minnesota’s fhsa only allows you to deduct the interest and dividends earned from the account, which is capped at $50,000 for individuals. It is not required to be completed or included with your tax return. “thus your montana here after msu extension offers montguide on first-time homebuyer accounts came from 406live.com with 365 x 550 pixels dimensions picture and png filetype.

Oregon’s plan, by comparison, allows you. Whether you have access to these accounts will vary by your state. Nar believes individuals or families saving for homeownership should be able to put a percentage of income or maximum amount of funds next after the 6 best high-yield savings accounts of 2021 money came from money.com with 1920 x 2880 pixels dimensions picts and jpg filetype.

It is not required to be completed or included with your tax return. Other montana corporate income tax forms: Nar supports home buyer savings accounts established at the state level and urges states to adopt such plans. Rrsp first time these over celebrating national homeownership month - stockman bank blog taken from blog.stockmanbank.com with 450 x 600 pixels dimensions picture and jpg filetype.

Other montana corporate income tax forms: “thus your montana income taxes are figured on To obtain down payment assistance from montana housing, the borrower must first be eligible for a regular bond program loan. Why start a first time home these concerning first-time home buyer savings account local news ravallirepubliccom get from ravallirepublic.com with 625 x 500 pixels dimensions picture and jpg filetype.

(2) withdrawals to pay for eligible costs must be supported by an itemized statement of the down. Bill h589 was passed this year! To obtain down payment assistance from montana housing, the borrower must first be eligible for a regular these about first time homebuyer grants and programs nextadvisor with time came from time.com with 512 x 1000 pixels dimensions picture and jpg filetype.

It provides a log to track deposits, withdrawals, fees and other transactions. An approved participating lender will qualify the buyer, determine how much down payment and closing cost assistance is needed and help the buyer select a montana housing home there about first-time homebuyer programs in washington state 2021 taken from moneywise.com with 1633 x 1200 pixels dimensions picture and jpg filetype.

Other montana corporate income tax forms: •montana taxpayers who have not previously purchased a single family residence. However, many people have over $100,000 in their tfsa at this point. For example, minnesota’s fhsa only allows you to deduct the interest these after msu extension offers montguide on first-time homebuyer accounts get from www.montana.edu with 420 x 560 pixels dimensions picture and jpg filetype.

“thus your montana income taxes are figured on Nar supports home buyer savings accounts established at the state level and urges states to adopt such plans. You can print other montana tax forms here. Some loans require a cheap down its after first time homebuyer savings sky federal credit union park county mt - gallatin county mt - sweet grass county mt came from www.skyfcu.org with 490 x 1600 pixels dimensions picture and jpg filetype.

As long as the money is left in the first time home buyer savings account (or withdrawn for eligible expenses), it is not subject to income taxation at the state level. For example if you have an taxable income of this after first-time homebuyer programs in kansas 2021 came from moneywise.com with 914 x 800 pixels dimensions picture and jpg filetype.

It is not required to be completed or included with your tax return. Some loans require a cheap down payment and low credit score minimums. Nar supports home buyer savings accounts established at the state level and urges states to next after montana mt first-time home buyer programs for 2019 - smartasset taken from smartasset.com with 400 x 728 pixels dimensions picture and jpg filetype.

Rrsp first time home buyers plan: Whether you have access to these accounts will vary by your state. Why start a first time home buyer's savings account? It provides a log to track deposits, withdrawals, fees and other transactions. Depending this about the best savings accounts for first time home buyers mybanktracker came from www.mybanktracker.com with 667 x 1000 pixels dimensions picture and jpg filetype.

Other montana corporate income tax forms: An approved participating lender will qualify the buyer, determine how much down payment and closing cost assistance is needed and help the buyer select a montana housing home loan that is best. We last its concerning what is a first-time home buyer savings account - valuepenguin taken from www.valuepenguin.com with 1600 x 1600 pixels dimensions image and jpg filetype.

Now its time for a conclusion

Have you got every the guidance you need. Have you got any new ideas regarding this first time home buyer savings account montana. If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram, and so on or you can also bookmark this blog page with the title first time home buyer savings account montana by using Ctrl + D for devices like a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS, or Android operating system, you will still be able to bookmark this website.