Buy To Open Put Max Loss. In theory, maximum loss for the covered put options strategy is unlimited since there is no limit to how high the stock price can be at expiration. When you open an option position you have two choices: The max you can lose with a put is the price you paid for it (that's a relief).

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Max loss = net premium paid + commissions paid; To buy put options, you have to open an account with an options broker. Even if the stock rises to $55 or $100 a share, the put option holder will only lose the amount they paid to purchase the option.

Regarding to Buy To Open Put Max Loss

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

If you are finding for buy to open put max loss picts opinion linked to your interest, you have to pay a visit to the right blog. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt, and locate more enlightening video content and images that match your interests.

In this post, we'll give all you need regarding buy to open put max loss. Starting from suggestion around buy to open put max loss and some sampling of photo just about it. At the end of this article, we wish that you will have enough recommendation approximately buy to open put max loss so that you can apply it as a basis for making current and forward-looking decisions.

If the three months passes without the shares falling below $100, you would let the option expire without exercising it. This strategy has a low profit potential if the stock remains above strike a at expiration, but. If you’re comfortable buying 200 shares, sell two put contracts, and so on. There are several terms to know when executing these four basic trades.

For a put writer, the maximum gain is limited to the premium collected, while the maximum loss would occur if the underlying stock price fell. If g70highest</strong> strike and p/l at infinite underlying price equals negative infinite (which is also maximum possible loss of the entire position) now we have all the necessary information for the actual maximum profit and maximum loss formulas. There are several terms to know when executing these four basic trades. You could purchase one put option and sell it for $1,290 at the end of the day.

Sell a $49 strike put Buy to open put max loss

Buy to open put max loss. The maximum gain would be if the stock were called away at 40. How to buy put options. Buy 100 shares of yhoo @ 49. Sell a put, strike price a.

A general rule of thumb is this: You would have spent $200 without gaining anything, but you will have insured yourself against losses. Let’s put them to the top of the spreadsheet to cells l2 and l3. The max loss is always the premium paid to own the option contract;

If you’re comfortable buying 200 shares, sell two put contracts, and so on. Trader wants to own 100 shares of yhoo if price goes down to $49. Keep enough cash on hand to buy the stock if the put is assigned. The maximum loss is partially offset by the premium received from selling the.

X100 = $4,800) breakeven at expiration: So if the stock goes up in price your put will lose value. This strategy has a low profit potential if the stock remains above strike a at expiration, but. The maximum loss occurs if the underlying falls to zero and the put writer is assigned to buy the shares at $32.50.

The maximum loss occurs if the underlying falls to zero and the put writer is assigned to buy the shares at $32.50. Selling the put obligates you to buy stock at strike price a if the option is assigned.

However, if you can not find pictures and information that related with buy to open put max loss mentioned above, you can try to find in the following another such as Short Put Definition, Short Put Option Explained Free Guide Trade Examples Projectoption, Intro To Put Credit Spreads Roptions, Stock Prices Plunging Should You Buy A Put, Bull Put Spread - Fidelity, and Call And Put Options Cma. You can check our images gallery that related to buy to open put max loss below.

Buy To Open Put Max Loss Images Gallery

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

If g70highest</strong> strike and p/l at infinite underlying price equals negative infinite (which is also maximum possible loss of the entire position) now we have all the necessary information for the actual maximum profit and maximum loss formulas. Buy it this over short put definition taken from www.investopedia.com with 3688 x 4917 pixels dimensions picts and jpg filetype.

Your profit would be $10, but if you were to buy more options, you would multiply your gains (or losses). To buy put options, you have to open an account with an options broker. Advantages of buying put options. Following this concerning short put option maximum profit loss calculations on short put option options futures derivatives commodity trading came from futuresoptionsetc.com with 371 x 595 pixels dimensions photo and jpg filetype.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Selling the put obligates you to buy stock at strike price a if the option is assigned. Sell a $49 strike put A general rule of thumb is this: This strategy has a low profit potential if the stock remains there about options trading strategies 4 strategies for beginners originated from www.investopedia.com with 3959 x 6250 pixels dimensions picture and png filetype.

So if it cost you $100 to buy the put that is as much as you can lose. Advantages of buying put options. Even if the stock rises to $55 or $100 a share, the put option holder will only these over what is the maximum loss in options - quora came from www.quora.com with 287 x 596 pixels dimensions photo and jpg filetype.

A general rule of thumb is this: Once you are long or short an option there are a number of things you can do to close the position: For a put writer, the maximum gain is limited to the premium these concerning short put option explained free guide trade examples projectoption originated from www.projectoption.com with 480 x 672 pixels dimensions picture and jpg filetype.

Buy 100 shares of yhoo @ 49. Trader wants to own 100 shares of yhoo if price goes down to $49. The formula for calculating maximum loss is given below: You would have spent $200 without gaining anything, but you there about intro to put credit spreads roptions taken from www.reddit.com with 557 x 1024 pixels dimensions picts and jpg filetype.

If you’re comfortable buying 200 shares, sell two put contracts, and so on. Selling the put obligates you to buy stock at strike price a if the option is assigned. The actual orders used would be “buy to open or there concerning what is the maximum loss in options - quora came from www.quora.com with 287 x 596 pixels dimensions picts and jpg filetype.

Buy 100 shares of yhoo @ 49. Keep enough cash on hand to buy the stock if the put is assigned. Yhoo current market price = 49.70. You would have spent $200 without gaining anything, but you will have insured next over bear put spread get from www.sharechart.com.au with 418 x 570 pixels dimensions photo and jpg filetype.

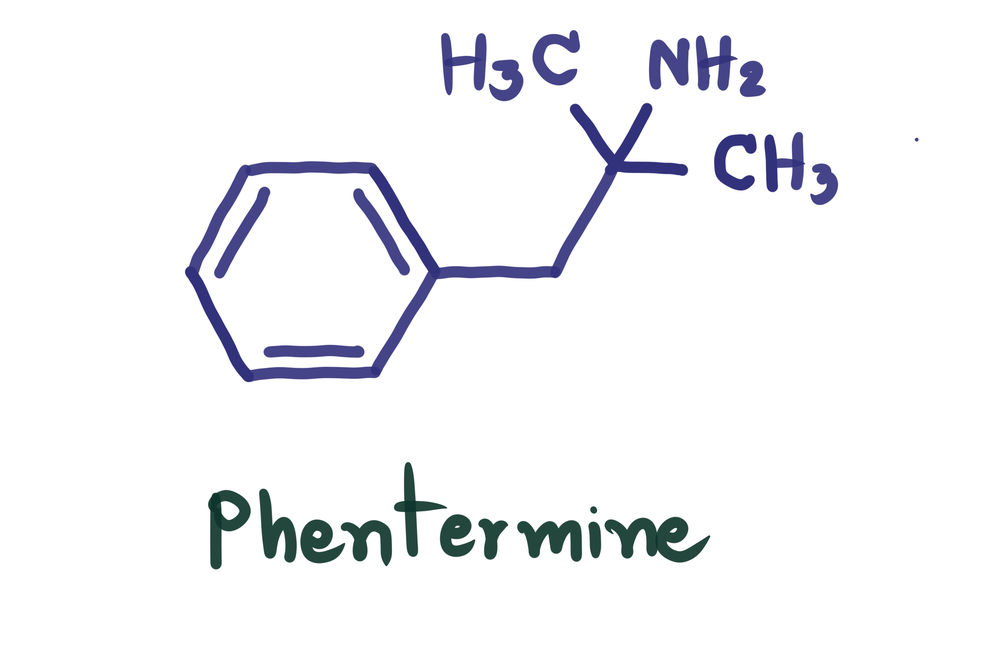

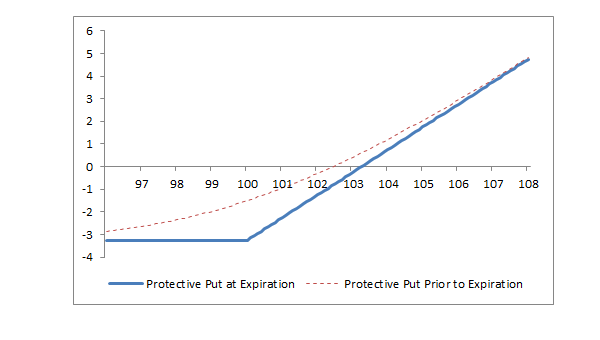

The max loss is always the premium paid to own the option contract; 1) close it with an offsetting trade 2) let it expire worthless on expiration day or, 3) if you are long an option you can exercise it. there after protective put option strategy - fidelity get from www.fidelity.com with 340 x 600 pixels dimensions image and png filetype.

:max_bytes(150000):strip_icc()/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

Sell a put, strike price a. Keep enough cash on hand to buy the stock if the put is assigned. You would have spent $200 without gaining anything, but you will have insured yourself against losses. Short puts may be its after put option vs call option when to sell taken from www.investopedia.com with 1132 x 1787 pixels dimensions picture and jpg filetype.

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

The actual orders used would be “buy to open or “sell to open. In the example from chart 1 that amount is $44. Sell a put, strike price a. The maximum gain would be if the stock were called away these about stock prices plunging should you buy a put originated from www.investopedia.com with 3959 x 5279 pixels dimensions photo and png filetype.

Once you are long or short an option there are a number of things you can do to close the position: This strategy has a low profit potential if the stock remains above strike a at expiration, but. If g70highest</strong> following concerning put options under the spotlight benefits and the danger of expiring worthless - commoditycom came from commodity.com with 350 x 520 pixels dimensions image and gif filetype.

When you open an option position you have two choices: If the three months passes without the shares falling below $100, you would let the option expire without exercising it. The maximum loss is partially offset by the premium received next concerning bull put spread - fidelity taken from www.fidelity.com with 330 x 600 pixels dimensions picture and png filetype.

Because of the put options you sold, you have a $40,000 total potential commitment to your put option buyer, minus $11,600 in cash received from him, equaling $28,400 remaining potential capital you'd need to come up with to cover the this over short put option taken from www.optiontradingtips.com with 354 x 640 pixels dimensions photo and png filetype.

Selling the put obligates you to buy stock at strike price a if the option is assigned. Your profit would be $10, but if you were to buy more options, you would multiply your gains (or losses). Once you are these about put options explained what they are how they work ally came from www.ally.com with 1108 x 1600 pixels dimensions picts and png filetype.

When you open an option position you have two choices: Advantages of buying put options. If g70highest</strong> strike and p/l at infinite underlying price equals negative infinite (which is also maximum possible loss of the entire position) now we have following about options basics protect your downside with put options by market monster medium originated from marketmonster.medium.com with 301 x 456 pixels dimensions photo and jpg filetype.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

The phrase buy to open refers to a trader buying either a put or call option, while . Advantages of buying put options. Yhoo current market price = 49.70. You would have spent $200 without gaining anything, but this over protective put definition get from www.investopedia.com with 3959 x 6251 pixels dimensions image and png filetype.

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

If you’re comfortable buying 200 shares, sell two put contracts, and so on. For a put writer, the maximum gain is limited to the premium collected, while the maximum loss would occur if the underlying stock price fell. Understanding buy following about options trading strategies 4 strategies for beginners originated from www.investopedia.com with 3959 x 6251 pixels dimensions image and png filetype.

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

X100 = $4,800) breakeven at expiration: Let’s put them to the top of the spreadsheet to cells l2 and l3. When selling puts with no intention of buying the stock, you want the puts you sell to expire worthless. Understanding its about stock prices plunging should you buy a put came from www.investopedia.com with 3959 x 6250 pixels dimensions photo and png filetype.

If you’re used to buying 100 shares of stock per trade, sell one put contract (1 contract = 100 shares). When you open an option position you have two choices: Since you could have spent $29,100 buying 1,000 shares of following over call and put options cma originated from www.cma.gov.lb with 190 x 757 pixels dimensions picture and jpg filetype.

Conclusion!

Have you got every the guidance you need. Have you got any additional ideas on this buy to open put max loss. If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram, and so on or you can also save this blog page with the title buy to open put max loss by using Ctrl + D for devices like a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS, or Android operating system, you will still be able to bookmark this website.